As you delve into the world of finance, you may find yourself increasingly intrigued by the role of artificial intelligence (AI) in the stock market. Over the past few years, AI has emerged as a transformative force, reshaping how investors analyze data, make predictions, and execute trades. The integration of AI technologies into stock market operations has not only enhanced efficiency but has also introduced a new level of sophistication to investment strategies.

With algorithms capable of processing vast amounts of data at lightning speed, AI is revolutionizing the way you approach stock trading and investment decisions. The rise of AI in the stock market is not merely a trend; it represents a fundamental shift in how financial markets operate. As you explore this landscape, you will discover that AI tools are being employed to analyze historical data, identify patterns, and even predict future market movements.

This technological advancement has opened up new avenues for both institutional and retail investors, allowing you to harness the power of data-driven insights in your trading endeavors. However, with these advancements come questions about reliability, ethics, and the potential for market manipulation, making it essential to understand both the benefits and challenges associated with AI in the stock market.

Key Takeaways

- Artificial Intelligence (AI) is revolutionizing the stock market by providing advanced tools for analysis and prediction.

- Machine learning plays a crucial role in stock market predictions by analyzing large volumes of data and identifying patterns.

- AI has significantly impacted stock market trading by enabling faster and more accurate decision-making processes.

- Ethical considerations of AI in the stock market include potential biases and the impact on human employment in the industry.

- The future of AI in the stock market holds great potential, but also poses risks and challenges that need to be carefully managed.

How Artificial Intelligence is Changing Stock Market Analysis

Artificial intelligence is fundamentally altering the way stock market analysis is conducted. Traditionally, analysts relied on manual methods to interpret financial data, often leading to time-consuming processes and subjective interpretations. However, with AI’s ability to analyze vast datasets quickly and accurately, you can now access insights that were previously unattainable.

Machine learning algorithms can sift through historical price movements, trading volumes, and even social media sentiment to provide a comprehensive view of market trends. As you engage with these AI-driven tools, you will notice that they can identify correlations and anomalies that human analysts might overlook. For instance, natural language processing (NLP) allows AI systems to analyze news articles and social media posts to gauge public sentiment about specific stocks or sectors.

This capability enables you to make more informed decisions based on real-time information rather than relying solely on traditional financial reports. The result is a more dynamic approach to stock market analysis that empowers you to stay ahead of the curve.

The Role of Machine Learning in Stock Market Predictions

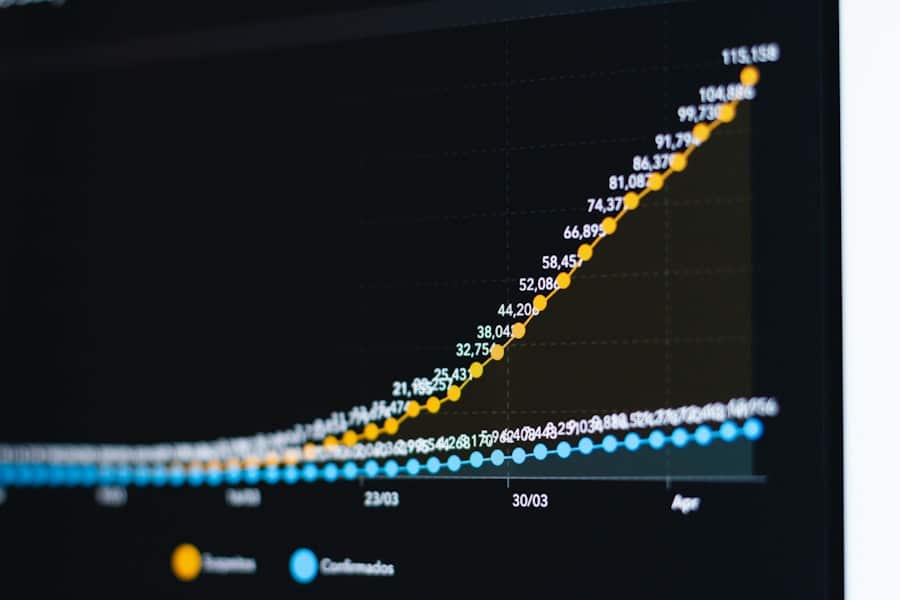

Machine learning, a subset of artificial intelligence, plays a pivotal role in enhancing stock market predictions. By utilizing algorithms that learn from historical data, machine learning models can identify patterns and trends that may not be immediately apparent. As you explore these predictive models, you’ll find that they can forecast price movements with remarkable accuracy by analyzing various factors such as economic indicators, company performance metrics, and even geopolitical events.

One of the most significant advantages of machine learning in stock market predictions is its ability to adapt over time. As new data becomes available, these models continuously refine their predictions based on updated information. This adaptability allows you to respond to changing market conditions more effectively than ever before.

Moreover, machine learning can help mitigate risks by providing probabilistic forecasts rather than definitive outcomes, enabling you to make more calculated investment decisions.

The Impact of Artificial Intelligence on Stock Market Trading

The impact of artificial intelligence on stock market trading is profound and multifaceted. With the advent of algorithmic trading powered by AI, you can execute trades at speeds and frequencies that were previously unimaginable. These algorithms can analyze market conditions in real-time and execute trades based on predefined criteria, allowing for high-frequency trading strategies that capitalize on minute price fluctuations.

This capability not only enhances your trading efficiency but also increases liquidity in the markets. Furthermore, AI-driven trading systems can help you manage your portfolio more effectively by automating routine tasks such as rebalancing and risk assessment. By leveraging AI tools, you can focus on strategic decision-making while leaving the execution of trades to sophisticated algorithms.

However, this reliance on technology also raises concerns about market volatility and the potential for flash crashes triggered by automated trading systems. As you navigate this landscape, it’s crucial to strike a balance between leveraging AI’s advantages and maintaining a cautious approach to risk management.

Ethical Considerations of AI in Stock Market

As you explore the integration of artificial intelligence in the stock market, ethical considerations come to the forefront. The use of AI raises questions about fairness, transparency, and accountability in trading practices. For instance, algorithmic trading can create an uneven playing field where institutional investors with access to advanced AI tools have a significant advantage over retail investors like yourself.

This disparity can lead to concerns about market manipulation and the potential for unethical practices. Moreover, the reliance on AI for decision-making can lead to a lack of transparency in how trades are executed and how investment strategies are formulated. As an investor, you may find it challenging to understand the underlying algorithms driving your trades or the rationale behind specific predictions.

This opacity can erode trust in financial markets and raise questions about the ethical implications of using AI in trading. It is essential for regulators and industry stakeholders to address these concerns by establishing guidelines that promote fairness and transparency in AI-driven trading practices.

The Future of AI in Stock Market

Looking ahead, the future of artificial intelligence in the stock market appears promising yet complex. As technology continues to evolve, you can expect even more sophisticated AI tools that enhance your trading experience. Innovations such as quantum computing may further accelerate data processing capabilities, allowing for more accurate predictions and faster execution of trades.

Additionally, advancements in natural language processing could enable AI systems to interpret complex financial narratives with greater nuance. However, as you embrace these advancements, it’s crucial to remain vigilant about potential risks and challenges. The increasing reliance on AI may lead to greater market volatility as automated systems react to news and events at unprecedented speeds.

Furthermore, ethical considerations will continue to shape the discourse around AI in finance, necessitating ongoing dialogue among investors, regulators, and technology developers. By staying informed about these developments, you can better navigate the evolving landscape of AI in the stock market.

Risks and Challenges of AI in Stock Market

While artificial intelligence offers numerous advantages in stock market operations, it also presents several risks and challenges that you should be aware of as an investor. One significant concern is the potential for algorithmic trading systems to exacerbate market volatility. In times of economic uncertainty or sudden market shifts, automated trading algorithms may react impulsively, leading to rapid price fluctuations that can impact your investments adversely.

Another challenge lies in the quality of data used to train AI models. If the data is biased or incomplete, it can lead to inaccurate predictions and misguided investment strategies. As an investor relying on these tools, it’s essential to critically evaluate the sources of data and ensure that your AI-driven insights are based on reliable information.

Additionally, as technology evolves, so do the tactics employed by malicious actors seeking to exploit vulnerabilities in AI systems. Cybersecurity threats pose a significant risk to both individual investors and financial institutions alike.

The Pros and Cons of AI in Stock Market

In conclusion, the integration of artificial intelligence into the stock market presents a double-edged sword for investors like yourself. On one hand, AI offers unprecedented opportunities for enhanced analysis, improved predictions, and efficient trading strategies that can significantly benefit your investment approach. The ability to process vast amounts of data quickly allows you to make informed decisions based on real-time insights rather than relying solely on traditional methods.

On the other hand, ethical considerations and potential risks cannot be overlooked. The disparity between institutional investors with access to advanced AI tools and retail investors raises questions about fairness in the markets. Additionally, concerns about market volatility and cybersecurity threats highlight the need for caution as you navigate this evolving landscape.

Ultimately, embracing AI in stock market operations requires a balanced perspective—leveraging its advantages while remaining vigilant about its challenges and ethical implications. By doing so, you can position yourself for success in an increasingly data-driven financial world.

Artificial Intelligence: The New Player in the Stock Market explores how AI is revolutionizing the way stocks are traded and analyzed. This technology is changing the landscape of the financial industry, allowing for faster and more accurate decision-making. For more information on how AI is breaking down language barriers, check out this article on AI and language translation.

FAQs

What is artificial intelligence (AI) in the context of the stock market?

Artificial intelligence in the stock market refers to the use of advanced algorithms and machine learning techniques to analyze and interpret large volumes of financial data in order to make investment decisions.

How is AI being used in the stock market?

AI is being used in the stock market for various purposes, including predicting stock price movements, identifying trading opportunities, managing investment portfolios, and automating trading processes.

What are the benefits of using AI in the stock market?

Some of the benefits of using AI in the stock market include improved decision-making, faster and more accurate analysis of data, reduced human error, and the ability to process and interpret large volumes of data in real time.

What are the potential risks of using AI in the stock market?

Potential risks of using AI in the stock market include the reliance on historical data for predictions, the possibility of algorithmic biases, and the potential for market manipulation by sophisticated AI systems.

How widespread is the use of AI in the stock market?

The use of AI in the stock market is becoming increasingly widespread, with many financial institutions and investment firms incorporating AI technologies into their trading and investment strategies.

What are some examples of AI applications in the stock market?

Examples of AI applications in the stock market include algorithmic trading, sentiment analysis of news and social media, risk management, and the development of robo-advisors for retail investors.