In an increasingly digitized world, the threat of financial fraud looms large, posing a significant challenge for individuals and businesses alike. However, thanks to the advancements in Artificial Intelligence (AI), there is a newfound hope in combatting this menace. By deploying AI-powered fraud detection systems, financial transactions can be safeguarded, providing enhanced security and peace of mind. From identifying patterns to analyzing vast amounts of data in real-time, AI plays a pivotal role in thwarting fraudulent activities and ensuring the integrity of financial transactions.

The Significance of AI in Fraud Detection

Introduction to AI in fraud detection

In today’s rapidly evolving digital landscape, the threat of financial fraud looms larger than ever before. With the increasing sophistication of fraudulent activities, traditional methods of fraud detection are proving to be inadequate. However, the emergence of Artificial Intelligence (AI) has transformed the way we combat fraud. AI, with its ability to analyze vast amounts of data, detect patterns, and make real-time decisions, has become an indispensable tool in fraud detection.

Benefits of using AI in fraud detection

The use of AI in fraud detection offers numerous benefits that are revolutionizing the way we tackle financial fraud. Firstly, AI enables the collection and analysis of large volumes of data, allowing for a more comprehensive understanding of fraudulent activities. This allows financial institutions to identify potential threats and patterns that may have otherwise gone unnoticed. Furthermore, AI systems can continuously learn and improve from new data, adapting to changing fraud techniques and minimizing false positives. The real-time detection and response capabilities of AI also enable swift action to be taken, preventing further damage.

Challenges in implementing AI for fraud detection

While AI offers immense potential in combating fraud, its implementation does come with challenges. One major challenge is ensuring the quality and accessibility of data. AI models heavily rely on data for training, and if the data is inaccurate or insufficient, it can hamper the effectiveness of the system. Additionally, training and fine-tuning AI models can be a complex process, requiring significant computational resources and expertise. Keeping up with evolving fraud techniques is another challenge, as fraudsters continually adapt their methods to avoid detection. Finally, the interpretability and explainability of AI decisions can raise concerns, as it may be difficult to understand the reasoning behind certain decisions made by AI systems.

Common Types of Financial Fraud

Identity theft

Identity theft occurs when someone illegally obtains another person’s personal information, such as their name, social security number, or credit card details, and uses it for fraudulent purposes. This type of fraud can lead to significant financial losses and damage to one’s reputation.

Credit card fraud

Credit card fraud involves the unauthorized use of someone’s credit card information to make fraudulent purchases or withdrawals. This can occur through various methods, such as cloning credit cards, stealing card details online, or intercepting card information during transactions.

Money laundering

Money laundering refers to the process of making illegally obtained money appear legitimate by disguising its source. This involves conducting a series of transactions to obscure the origins of the funds and make them appear as legitimate income.

Phishing scams

Phishing scams involve fraudulent attempts to obtain sensitive information, such as passwords, credit card details, or social security numbers, by posing as a trustworthy entity in electronic communication. These scams often use deceptive tactics to trick individuals into revealing their personal information.

Account takeover

Account takeover occurs when fraudsters gain unauthorized access to someone’s online account, such as their bank account or email account. Once they have access, they can engage in various fraudulent activities, such as making unauthorized transactions or stealing sensitive information.

Insider fraud

Insider fraud refers to fraudulent activities committed by individuals within an organization. This can include embezzlement, falsifying records, or abusing their positions of trust for personal gain. Insider fraud can be particularly challenging to detect, as perpetrators are often familiar with the organization’s systems and processes.

How AI Detects and Prevents Fraud

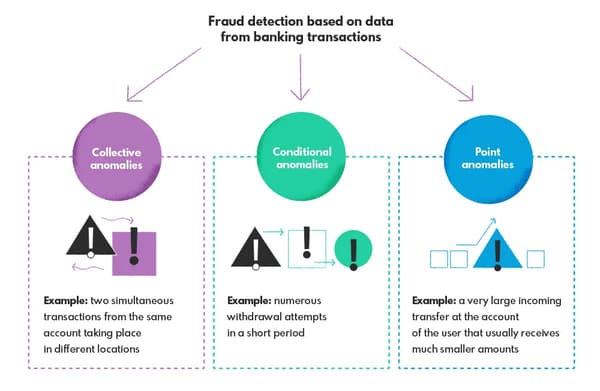

Data collection and analysis

AI systems for fraud detection collect and analyze vast amounts of data to uncover patterns and anomalies that may indicate fraudulent behavior. This includes data from multiple sources, such as transaction records, user profiles, and external databases. By analyzing this data, AI algorithms can identify suspicious activities and flag them for further investigation.

Behavioral analysis

AI systems use behavioral analysis to establish baseline patterns of behavior for individual users. By analyzing user behavior over time, AI algorithms can detect deviations from the norm that may indicate fraudulent activities. For example, if a user suddenly starts making large transactions outside of their usual spending habits, it may raise a red flag and trigger further investigation.

Real-time monitoring

AI enables real-time monitoring of financial transactions and activities, allowing for immediate detection of potential fraud. By analyzing transactions as they occur, AI systems can flag suspicious activities in real-time, enabling swift intervention to prevent further damage. This real-time monitoring can be particularly beneficial in combating fast-paced and evolving fraud techniques.

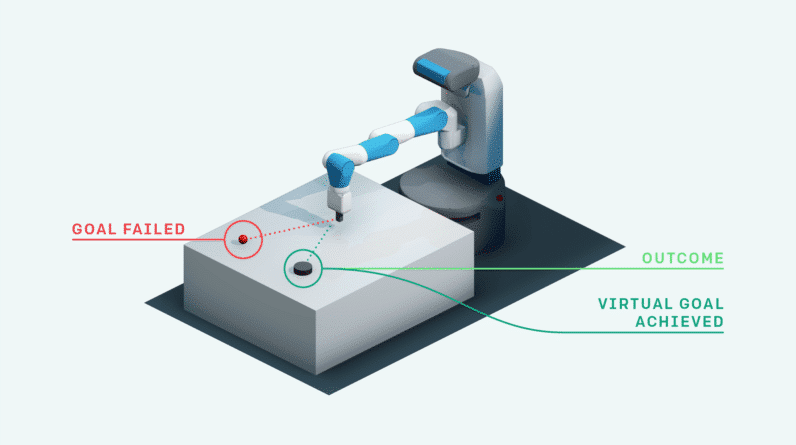

Machine learning algorithms

Machine learning algorithms play a crucial role in fraud detection. These algorithms can learn from historical data and continually improve their performance over time. By analyzing past fraudulent activities, machine learning algorithms can identify common patterns and characteristics associated with fraud. This allows them to detect and prevent similar fraudulent activities in the future.

Pattern recognition

AI systems excel at pattern recognition, allowing them to detect complex and intricate fraud patterns that may be undetectable to human analysts. By analyzing large datasets and identifying correlations and anomalies, AI systems can uncover hidden patterns and trends indicative of fraudulent behavior. This ability to recognize patterns enables AI algorithms to stay one step ahead of fraudsters and detect new fraud techniques as they emerge.

AI Tools and Technologies for Fraud Detection

Predictive analytics

Predictive analytics uses AI to analyze historical and real-time data to predict future events, such as potential fraudulent activities. By identifying patterns and trends in data, predictive analytics can generate insights and predictions that help in fraud prevention.

Natural language processing (NLP)

NLP technology enables AI systems to understand and analyze human language, including text and speech. In the context of fraud detection, NLP can be used to extract information from unstructured data sources, such as social media posts or customer reviews, to identify potential fraud indicators.

Machine learning

Machine learning algorithms allow AI systems to learn from data and improve their performance over time. By training these algorithms on historical data, they can identify patterns and anomalies associated with fraudulent activities, enabling more accurate fraud detection.

Deep learning

Deep learning is a subset of machine learning that utilizes neural networks with multiple layers to extract complex patterns and relationships from data. Deep learning algorithms are particularly effective in fraud detection as they can automatically learn and adapt to new fraud patterns without human intervention.

Neural networks

Neural networks are AI models inspired by the human brain, consisting of interconnected nodes or “neurons.” These networks can be trained to recognize patterns and make decisions based on the input data. In fraud detection, neural networks are used to analyze large datasets and identify fraudulent patterns and behaviors.

Graph analytics

Graph analytics involves analyzing the relationships and connections between entities in a network. In the context of fraud detection, graph analytics can uncover hidden networks of fraudsters or identify suspicious connections between seemingly unrelated entities, helping to detect fraudulent activities.

Benefits of AI in Fraud Detection

Improved accuracy and efficiency

AI systems have the ability to analyze vast amounts of data quickly and accurately, far surpassing human capabilities. This enables them to identify suspicious patterns and behaviors that may go unnoticed by human analysts. By automating the fraud detection process, AI significantly improves the accuracy and efficiency of fraud detection efforts.

Real-time detection and response

The real-time monitoring capabilities of AI systems enable the detection of fraud as it occurs, allowing for immediate intervention. This real-time detection and response can prevent further financial losses and mitigate the impact of fraudulent activities. By minimizing the response time, AI helps financial institutions stay one step ahead of fraudsters.

Reduced false positives

Traditional fraud detection methods often generate a high number of false positives, leading to inefficient use of resources and frustrating experiences for customers. AI systems, with their ability to analyze vast amounts of data and learn from patterns, can significantly reduce false positives by accurately distinguishing between legitimate and fraudulent activities.

Adaptability to changing fraud patterns

Fraudsters continually evolve their techniques to evade detection, making it challenging for traditional fraud detection systems to keep up. AI systems, with their ability to learn and adapt, can quickly adjust to new fraud patterns and identify previously unseen fraudulent activities. This adaptability makes AI invaluable in the fight against ever-changing fraud techniques.

Cost-saving opportunities

Implementing AI in fraud detection can lead to significant cost savings for financial institutions. By automating the fraud detection process and reducing false positives, AI systems optimize resource allocation and minimize the need for manual intervention. This allows organizations to allocate their resources more efficiently while effectively combating financial fraud.

Challenges in Implementing AI for Fraud Detection

Data quality and accessibility

The effectiveness of AI systems in fraud detection heavily relies on the quality and accessibility of data. If the data used to train these systems is inaccurate, incomplete, or biased, it can undermine the accuracy and reliability of the AI models. Ensuring the availability of high-quality and diverse data sets is crucial for successful AI implementation in fraud detection.

Training and fine-tuning AI models

Training AI models for fraud detection can be a complex and resource-intensive process. It requires significant computational resources and specialized expertise to develop and fine-tune these models. Continuous monitoring and improvement are necessary to ensure the models remain effective as fraud techniques evolve.

Keeping up with evolving fraud techniques

Fraudsters are constantly developing new techniques to evade detection, making it challenging for AI systems to keep pace. AI models need to be continuously updated and trained on new data to stay ahead of emerging fraud patterns. The ability to adapt quickly to new fraud techniques is essential for the effectiveness of AI in fraud detection.

Interpretability and explainability of AI decisions

The decisions made by AI systems can sometimes be difficult to interpret or explain. This lack of transparency can raise concerns, especially in applications such as fraud detection, where the consequences of incorrect decisions can be significant. Ensuring interpretability and explainability of AI models is crucial for building trust and acceptance of AI-powered fraud detection systems.

Security and privacy concerns

AI systems for fraud detection require access to sensitive financial and personal data, raising security and privacy concerns. Safeguarding this data from breaches and unauthorized access is essential to maintain customer trust. Organizations must implement robust security measures and adhere to strict data privacy regulations to protect customer information effectively.

Case Studies: Successful AI-Based Fraud Detection

Case study 1: XYZ Bank

XYZ Bank, a leading financial institution, implemented AI systems for fraud detection to enhance its fraud prevention efforts. By analyzing large volumes of transaction data in real-time, the AI systems identified fraudulent activities with greater accuracy and speed. This resulted in a significant reduction in financial losses due to fraud and improved customer satisfaction.

Case study 2: ABC Insurance

ABC Insurance leveraged AI technologies to detect fraudulent claims and improve the efficiency of their claims processing system. By analyzing historical claims data and identifying patterns indicative of fraud, the AI system automatically flagged suspicious claims for further investigation. This led to a considerable reduction in fraudulent claims, saving the company significant financial resources.

Case study 3: DEF Payment Processor

DEF Payment Processor implemented AI-powered fraud detection systems to protect their payment processing platform from fraudulent activities. By analyzing transaction data and customer behavior, the AI systems detected unusual activity in real-time and immediately flagged it for further investigation. This proactive approach enabled DEF Payment Processor to prevent fraudulent transactions and maintain the trust of their customers.

Future Trends in AI and Fraud Detection

Advancements in deep learning and neural networks

As research and development in the field of deep learning and neural networks continue to progress, AI-powered fraud detection systems will become even more sophisticated. These advancements will enable AI systems to detect and prevent complex fraud patterns with even greater accuracy.

Integration of AI with blockchain technology

The integration of AI with blockchain technology holds immense potential for fraud detection. By leveraging the transparency and immutability of blockchain, AI systems can verify and validate transactions more effectively, reducing the risk of fraudulent activities.

Cross-industry collaboration in fraud prevention

The fight against fraud requires collaboration across industries and sharing of data and insights. As awareness of the benefits of AI in fraud detection grows, we can expect to see increased collaboration between financial institutions, law enforcement agencies, and technology companies to combat fraud more effectively.

Enhanced automation and real-time decision-making

With advancements in AI, we can expect to see increased automation in fraud detection processes. AI systems will be able to make real-time decisions autonomously, minimizing the need for human intervention. This will enable swift and effective response to emerging fraud patterns.

Ethical considerations in AI-powered fraud detection

As AI becomes more prevalent in fraud detection, ethical considerations surrounding its use will become increasingly important. Organizations must ensure that AI systems are used responsibly and ethically, respecting privacy rights and preventing potential biases in decision-making.

Best Practices for Implementing AI in Fraud Detection

Establishing clear fraud detection goals

Before implementing AI systems for fraud detection, organizations should clearly define their fraud detection goals. This includes identifying the specific types of fraud they aim to detect and prevent, as well as the desired outcomes of their fraud detection efforts.

Building a comprehensive fraud detection strategy

A comprehensive fraud detection strategy should involve a combination of AI systems, human expertise, and traditional fraud detection methods. Organizations should carefully design their strategy, considering factors such as data collection, analysis, real-time monitoring, and response mechanisms.

Combining AI with human expertise

While AI systems play a critical role in fraud detection, human expertise remains invaluable. Combining AI capabilities with human judgment and domain knowledge can lead to more effective and accurate fraud detection. Human analysts can provide additional insights and context to aid in the interpretation of AI-generated alerts.

Continuous monitoring and improvement

Implementing AI in fraud detection requires continuous monitoring and improvement. Organizations should regularly assess the performance of their AI systems, fine-tune models, and update training data to ensure optimal effectiveness. Ongoing monitoring allows organizations to stay ahead of emerging fraud patterns and refine their detection capabilities.

Ensuring regulatory compliance

Organizations must ensure that their AI-powered fraud detection systems comply with relevant laws and regulations. This includes data privacy regulations, security requirements, and any industry-specific regulations. Adhering to regulatory standards is crucial to maintain customer trust and avoid legal and reputational risks.

Conclusion

AI has emerged as a powerful tool in the fight against financial fraud. Its ability to analyze vast amounts of data, detect patterns, and make real-time decisions has revolutionized the field of fraud detection. By leveraging AI technologies, organizations can improve accuracy, efficiency, and real-time response in detecting and preventing fraudulent activities. However, implementing AI in fraud detection also comes with challenges, such as data quality, model training, and security concerns. By addressing these challenges and following best practices, organizations can unlock the full potential of AI in fraud detection and secure financial transactions in an increasingly digital world.